Asian equities ended broadly higher on Wednesday, with gains across most major markets driven by easing trade tensions and improving economic forecasts.

However, Japanese shares underperformed amid continued yen appreciation and weakening export growth, which weighed on sentiment.

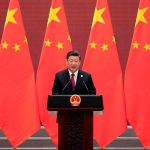

China and Hong Kong stocks rise

Chinese markets posted modest gains after Morgan Stanley raised its 2025 GDP forecast for China to 4.5%, citing improving trade dynamics.

The Hang Seng Index climbed 0.6% to 23,827.78, its highest close since March 24, while the Hang Seng Tech Index added 0.5%.

Electric vehicle makers led the rally in Hong Kong, with Li Auto and BYD each advancing around 4%.

Tech heavyweights also gained ground, with Alibaba up 1.2% and Tencent rising 0.7%.

Japanese stocks decline on Yen pressure

Japanese stocks closed lower as the yen continued to strengthen on expectations of a Bank of Japan rate hike.

The Nikkei 225 fell 0.61% to 37,298.98, while the Topix slipped 0.22% to 2,732.88.

The pressure on exporters was compounded by a second straight month of slowing export growth and heightened geopolitical tensions.

Tokio Marine Holdings dropped 2.6% following a downbeat profit forecast. In contrast, Mizuho Financial Group gained 2.7% after announcing plans to reduce its cross-shareholdings.

India market recovers after three-day decline

Indian shares rebounded modestly following three consecutive sessions of losses driven by geopolitical concerns and US economic uncertainty.

The S&P BSE Sensex rose 0.51%, or 410.19 points, to 81,596.63, led by gains in auto, IT, and healthcare stocks.

Morgan Stanley raised its Sensex target to 89,000 by June 2026, citing strong macro fundamentals and a positive corporate earnings outlook.

Moody’s noted that India remains relatively insulated from global trade disruptions due to its domestic demand-oriented economy.

Other regional markets

The Kospi Index in Seoul jumped 0.91% to 2,625.58 after recent losses, with gains led by Samsung Biologics, which surged 7.1%, and Hanwha Aerospace, up 4.3%.

In Australia, banking stocks lifted the market after the Reserve Bank of Australia delivered a widely anticipated rate cut.

The S&P/ASX 200 gained 0.52% to 8,386.80, its highest in over three months, while the All Ordinaries Index closed 0.45% higher at 8,611.70.

Wall Street on Tuesday

After eking out modest gains in the previous session, US stocks edged lower on Tuesday as investors booked profits following a sustained rally.

While the major indices recovered from intraday lows, they still ended the session in the red, with the Dow Jones Industrial Average falling 114.83 points, or 0.3%, to 42,677.24.

The Nasdaq Composite lost 72.75 points, or 0.4%, to close at 19,142.71, and the S&P 500 slipped 23.14 points, or 0.4%, to 5,940.46.

The pullback follows a sharp rebound from April lows, driven in part by easing trade tensions.

Both the Nasdaq and S&P 500 had recently touched their highest levels in nearly three months, prompting some traders to lock in gains.

However, underlying concerns remain. JPMorgan Chase CEO Jamie Dimon issued a cautionary note during the bank’s annual investor day on Monday, suggesting markets may be underestimating persistent inflation risks and the possibility of stagflation.

The post Asian stocks close mostly higher: Hang Seng up 0.5%, Nifty snaps losing streak appeared first on Invezz