European markets closed out a turbulent week with modest losses on Friday, as the intensifying tariff standoff between the United States and China continued to rattle global investor sentiment.

The pan-European Stoxx 600 index slipped 0.1%, retracing slightly after logging its strongest session since March 2022 on Thursday.

The UK’s FTSE 100 rose 0.64% after better-than-expected GDP data for February, while the mid-cap FTSE 250 was flat.

Germany’s DAX declined 0.9% and France’s CAC 40 dipped 0.3%.

The euro continued to strengthen, gaining 1.3% against the US dollar to reach $1.134 — its highest level since February 2022 — on the back of optimism over economic resilience in the eurozone.

Sector-wise, risk-off sentiment remained evident. Industrials, technology, and energy stocks stayed under pressure, while defensive sectors such as utilities and consumer durables attracted buyers.

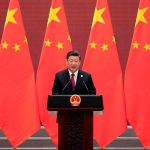

Trump tariff tensions dominate market narrative

The session capped a week marked by extreme volatility, fueled by policy uncertainty surrounding US President Donald Trump’s new tariff regime.

The White House’s initial move to impose steep “reciprocal tariffs” on nearly 90 countries and territories was walked back midweek, replaced by a 10% blanket levy for 90 days to allow for negotiations, excluding China, which faces a punitive 145% import duty.

In response, Beijing raised its tariffs on US goods to 125%, up from 84%, escalating fears of a prolonged disruption in global trade flows.

Despite these developments, European equities have shown greater resilience than their US counterparts.

While the S&P 500 has dropped nearly 11% year-to-date, the Stoxx 600 is down only 4.4%.

France’s CAC 40 has slipped 4%, the FTSE 100 is lower by about 3%, and Italy’s FTSE MIB has declined just 0.9%.

Germany’s DAX remains an outlier, up 2.4% so far in 2025.

Analysts attribute this relative outperformance to expectations that the economic fallout from the US-led trade conflict will be less severe in Europe.

Several Wall Street banks have noted that Europe’s diversified export base, stronger trade links with Asia outside of China, and more conservative monetary policy responses may cushion the impact.

US stocks on Friday

After starting the day in red, US stocks edged higher Friday as investors tried to find footing following a volatile week dominated by tariff headlines and economic data.

The S&P 500 rose 0.5%, the Dow Jones Industrial Average gained 140 points, or 0.4%, and the Nasdaq Composite climbed 0.7%.

The move higher came despite a setback in consumer sentiment data that briefly pressured equities.

The University of Michigan’s consumer sentiment index for April fell more than expected, signaling rising unease among households.

The University of Michigan’s latest consumer sentiment survey showed a sharp decline in confidence, with the index falling to 50.8 in April from 57 in March.

This marks one of the lowest readings since the pandemic-era lows and underscores rising anxiety among consumers amid inflation concerns and escalating trade tensions.

More notably, consumers’ year-ahead inflation expectations surged to their highest level since 1981, stoking concerns that price pressures could persist even as broader inflation gauges show signs of cooling.

The post European stocks wrap volatile week mixed: FTSE 100 inches higher, DAX dips appeared first on Invezz